Passive funds and ETFs won’t completely supplant active managers, but their market share will continue to rise.

In 2023, cash is far from trash.

That’s the verdict of the 404 professional and retail investors who took part in the latest MLIV Pulse survey. Two-thirds of respondents said the cash in their portfolios would bolster rather than drag down their performance in the year ahead.

That cash holds such allure says a lot about the unsettled financial and economic environment. Fears of a potential bear market, continued rate hikes by the Federal Reserve and a looming recession have investors nervous, worried that 2023 could be a reprise of 2022’s brutal hit to portfolios.

Morgan Stanley’s chief US equity strategist Michael Wilson told Bloomberg TV last week that the S&P 500 Index could fall around 20% due to weak corporate earnings. However, he expects stocks to rally in the short term if Treasury yields and the dollar continue to decline.

Investors Like Cash

Against that backdrop, cash looks like a safe haven, particularly with recent yields on short-term Treasury bills high enough to beat the classic 60/40 portfolio of stocks and bonds for the first time since 2001. Even high-yield savings accounts pay savers close to 4% now.

“We’re encouraging people that it’s okay to hold cash, that it’s not just a lead weight on your ankle weighing you down,” said Leo Kelly, chief executive officer at Verdence Capital Advisors. “You can get a nice yield and there will be a lot of volatility in the markets and lots of chances to put that cash to work at attractive levels.”

Investors also lose ground to inflation by holding cash, said Rachel Elson, a wealth advisor at Perigon Wealth Management. But for clients who have known expenses to save for, like an upcoming wedding or a looming tax bill, it’s less painful to be prudent when you can get 3.75% on a savings account from Marcus, Goldman Sachs Group Inc.’s consumer bank, Elson said.

The money that investors do put to work in the markets this year is more likely to go to passive funds than actively managed mutual funds. Only 17% of survey respondents said it’s highly likely that an average active large-cap US equity fund will outperform a passive fund tracking the S&P 500, after fees, in 2023.

When professional investors were asked whether they planned to increase their exposure to active funds, passive funds and international investments this year, the most popular answer was international exposure (47%), followed by putting more money in passive funds (37%), and increasing investment in active funds (30%).

Conversely, retail investors are more likely to put money into passive funds (46%), followed by international investments (38%) and actively managed funds (22%).

Investors See Lasting Demand for Active Funds

We asked: Do you think active mutual funds will be extinct in 10 years?

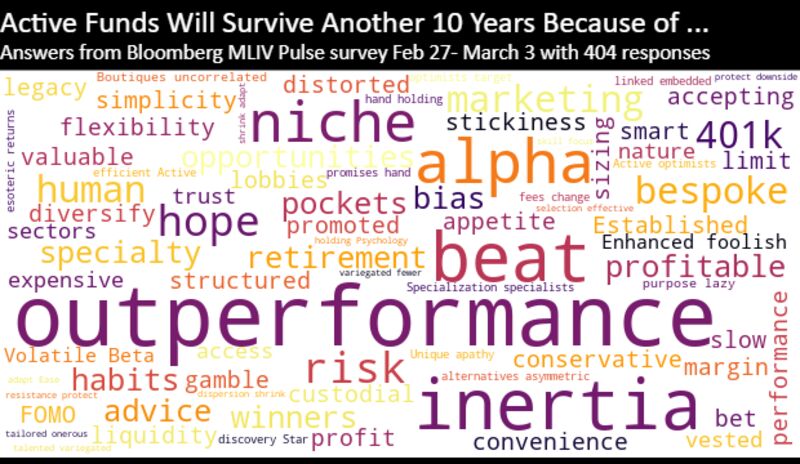

While most respondents think stockpickers will continue to lose market share to passive funds, they don’t expect active managers to go extinct in 10 years. Just 25% said they’ll cease to exist in the next decade, while the other three-quarters believe they’ll survive for reasons ranging from outperformance to inertia.

“Legacy is hard to kill,” one respondent wrote.

Some investors said active managers’ ability to be nimble and hold cash will make them an attractive option during uncertain times. “With persistently higher rates and less fast money, there will be great opportunities for concentrated, benchmark-agnostic, active managers to outperform,” wrote one respondent. On a fundamental level, “it’s human nature to seek above-average returns,” another person commented.

US stocks ended last week on a high note, driven by speculation that the Fed won’t raise interest rates beyond peak levels already priced in. Asian shares rose on Monday, taking the lead from Wall Street, although the rally was tempered by China’s modest economic growth target.

As investors weigh global risks, the week ahead brings a range of economic data and events for them to consider. In Asia, eyes remain on the National People’s Congress in Beijing for any further policy announcements and details that may set the tone for how market friendly — or harsh — regulation will be through 2023. The Bank of Japan’s policy decision on Friday will be the last under the current governor Haruhiko Kuroda.